[PRESS RELEASE – Mahe, Seychelles, October 4th, 2024]

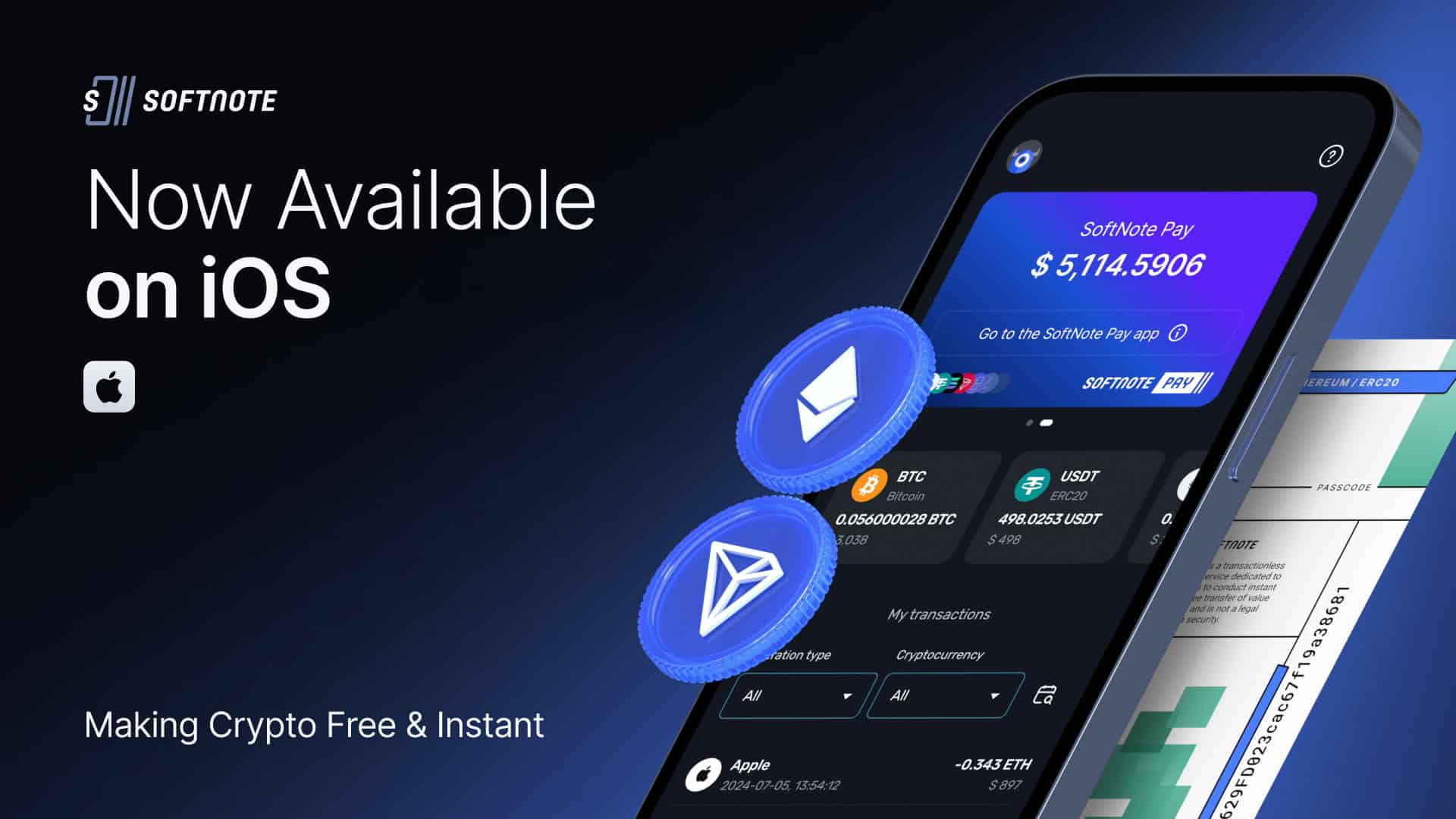

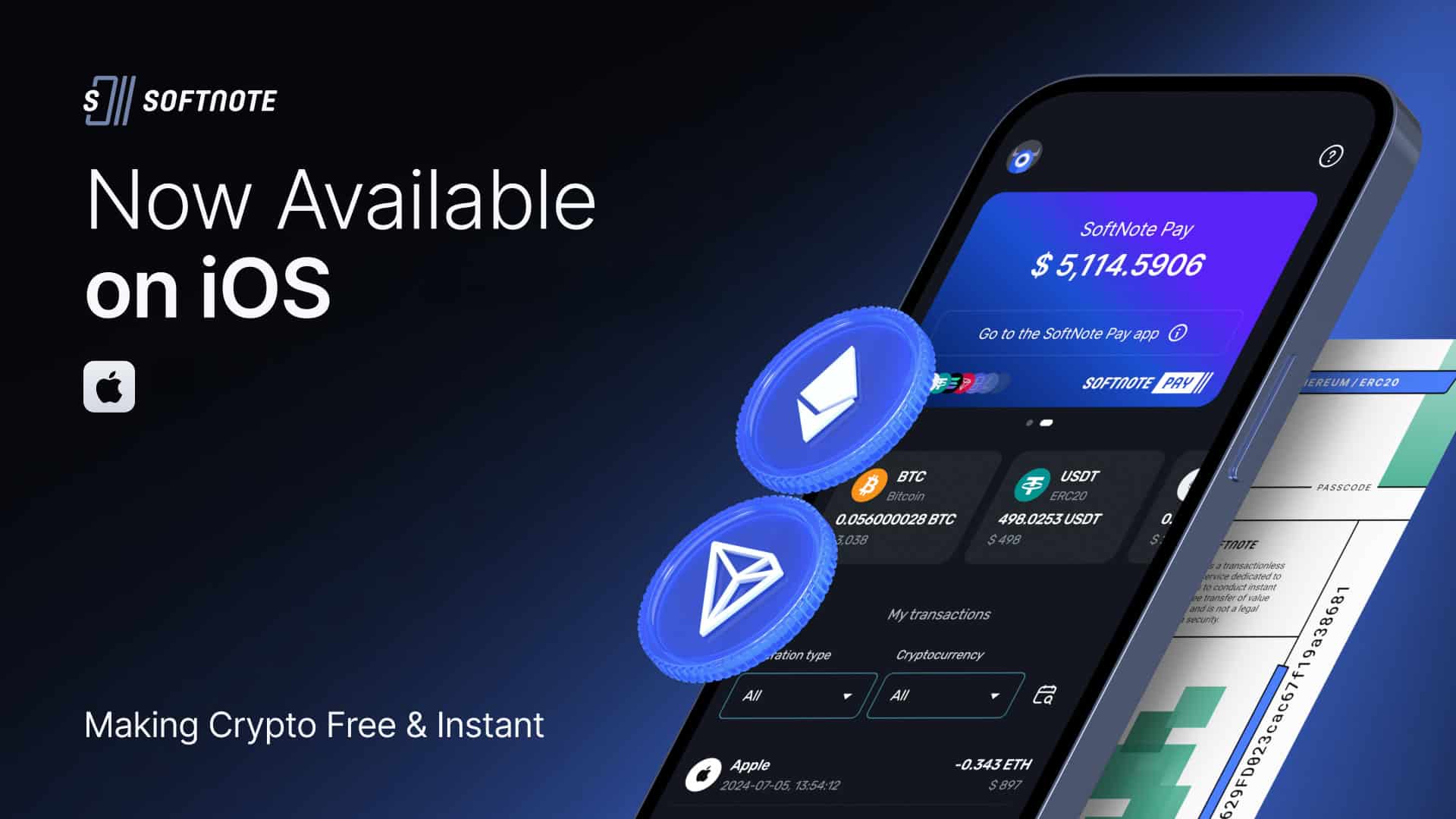

Tectum, the fastest blockchain network globally with 3.5 million transactions per second, announced the release of the SoftNote Wallet App on iOS, marking a significant step toward mass adoption of its SoftNote technology. Previously accessible only through a web interface, SoftNote now allows users to conduct instant and zero-fee crypto transactions directly from their mobile devices. Android users can look forward to the app’s release later this month.

The SoftNote Wallet App is currently available in the Apple App Stores in the USA, Russia, Turkey, India, and Brazil, with more markets to follow in the coming months, bringing this game-changing technology to a growing global audience. With SoftNote, Tectum eliminates the need for intermediaries, offering a seamless, bankless payment experience for users globally.

“The SoftNote Wallet puts this powerful technology directly into users’ hands, allowing them to transact freely without barriers,” said Alexander Guseff, Founder of Tectum. “This is a major step toward our vision of making crypto transactions free & instant.”

The app enables secure, real-time transactions with major cryptocurrencies such as Bitcoin, Ethereum, USDT, and Tectum Emission Tokens. Users can easily create, manage, and transfer SoftNote Bills through a streamlined, user-friendly interface designed for seamless navigation.

“SoftNote Wallet’s mobile release moves us closer to a world where global transactions no longer rely on traditional systems like SWIFT,” Gusev added. “We’re creating a faster, more secure, and cost-effective way to handle payments worldwide.”

About Tectum

Tectum is a blockchain pioneer redefining global remittance and payment systems with its SoftNote solution, offering a seamless, borderless platform for both fiat and crypto transactions.

For more information, users can visit

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!